You will need to modify your Quicken settings to ensure the smooth transition of your data. You will need your KFS Online Banking access ID and password.

Helpful Quicken and QuickBooks information. More support on Quicken and QuickBooks can be found at or. OFX Post Conversion Troubleshooting Guide Issue 1: Duplicate Transactions After Reconnecting Symptoms You Can Use to Identify the Issue The most common report from customers is about duplicate transactions. Some customers may say their register is out of balance or that they are being asked to add an adjustment during reconciliation. Fix the Issue. If the duplicate transactions have not been added to the register, they can be deleted individually prior to accepting. If the transactions have already been added to the register, they can be deleted from the register individually or in groups.

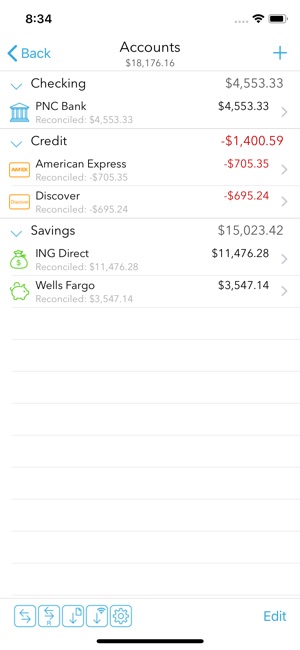

Preparation Deactivate Your Kfs Accounts In Quicken Quicken For Mac Download

QuickBooks Knowledge Base Article. Delete transactions from Online Banking Center: Quicken Details If there are too many transactions to delete individually, or the customer finds it difficult to follow the instructions to delete multiple transactions, restore a backup file and download the transactions again. Important: If the backup was not made right before following the conversion instructions, the customer must manually delete the transactions. Quicken Knowledge Base Articles. Edit and Download Investment Transactions:.

Delete Transactions:. Problem Description: Issue 2: Duplicate Accounts After Reconnecting Symptoms You Can Use to Identify the Issue Customers report that they are unable to link to an existing account, that they are prompted to create a new account, or that they are only given the choice to add a new account. Fix the Issue. First, confirm that all accounts have been deactivated, including inactive (QuickBooks) or hidden (Quicken) accounts. Then, if you’re working in QuickBooks, delete any downloaded transactions that do not match the register in the Online Banking Center. If you’re working in Quicken, delete the duplicate accounts. Finally, repeat the reconnection steps QuickBooks Knowledge Base Articles.

Add and match Bank Feed transactions:. Hide mistakenly-added accounts: Quicken Knowledge Base Articles. If the customer was prompted to create a new account:. If the customer needs to delete an account:.

If the customer needs to hide an account: Issue 3: Connected/Reconnected the Incorrect Account Symptoms You Can Use to Identify the Issue Customers report that their transactions are downloading into the wrong account Fix the Issue. First, open the account register for the incorrectly linked account. If the transactions have not yet been accepted into the register in QuickBooks, delete them in the Online Banking Center.

Then, deactivate the account. If the transactions have not yet been accepted into the register in Quicken, delete the transactions. If the transactions have already been added to the register in Quicken or QuickBooks, restore a backup. Finally, repeat the reconnection steps.

Be sure the customer links to the correct account when reconnecting. QuickBooks Knowledge Base Articles. Delete Non-matching Transactions: Quicken Knowledge Base Articles. Handling Transactions in the Wrong Account: Quicken for MAC 2016-2018 Conversion Instructions Introduction As Anoka Hennepin Credit Union completes its system conversion, you will need to modify your Quicken settings to ensure the smooth transition of your data. Please reference the dates next to each task as this information is time sensitive.

To complete these instructions, you will need your User ID and Password for online banking. You should perform the following instructions exactly as described and in the order presented. If you do not, your online banking connectivity may stop functioning properly. This conversion should take 15–30 minutes. Thank you for making these important changes! Documentation and Procedures Task 1: Conversion Preparation.

Backup your data file. For instructions to back up your data file, choose Help menu Search. Search for Backing Up, select Backing up data files, and follow the instructions. Download the latest Quicken Update. For instructions to download an update, choose Help menu Search. Search for Updates, select “Check for Updates,” and follow the instructions.

Task 2: Connect Accounts at Anoka Hennepin Credit Union on or after 7/30/2018. Select your account under the Accounts list on the left side. Choose Accounts menu Settings.

Select Set up transaction download. Enter Anoka Hennepin Credit Union in the Search field, select the name in the Results list and click Continue. Log in to Download a file of your transactions to your computer.

NOTE: Take note of the date you last had a successful connection. If you have overlapping dates in the web-connect process, you may end up with duplicate transactions. Drag and drop the downloaded file into the box Drop download file.

NOTE: Select “Web Connect” for the “Connection Type” if prompted. In the “Accounts Found” screen, ensure you associate each new account to the appropriate account already listed in Quicken. Under the Action column, select “Link” to pick your existing account. IMPORTANT: Do NOT select “ADD” under the action column unless you intend to add a new account to Quicken.

Click Finish. Repeat steps for each account to be connected. Quicken for MAC Conversion Instructions Introduction As Anoka Hennepin Credit Union completes its system conversion, you will need to modify your QuickBooks settings to ensure the smooth transition of your data. Please reference the dates next to each task as this information is time sensitive. To complete these instructions, you will need your User ID and Password for online banking. You should perform the following instructions exactly as described and in the order presented.

If you do not, your online banking connectivity may stop functioning properly. This conversion should take 15–30 minutes. Thank you for making these important changes!

Documentation and Procedures Task 1: Conversion Preparation. Backup your data file. For instructions to back up your data file, choose the Help menu and use the Search bar available at the top. Search for Back Up and follow the instructions on screen. The first time you do a backup, QuickBooks will guide you through setting backup preferences. Download the latest QuickBooks Update.

For instructions to download an update, choose Help menu and use the Search bar available at the top. Search for Update QuickBooks, select Check for QuickBooks Updates and follow the instructions. Task 2: Disconnect Accounts at Anoka Hennepin Credit Union on or after 7/30/2018.

Choose Lists menu Chart of Accounts. Select the account you want to deactivate. Choose Edit menu Edit Account. In the Edit Account window, click the Online Settings.

In the Online Account Information window, choose Not Enabled from the Download Transaction list and click Save. Click OK for any dialog boxes that may appear with the deactivation. Repeat steps for each account to be disconnected. Task 3: Reconnect Accounts to Anoka Hennepin Credit Union on or after 7/30/2018. Log in to and download your QuickBooks Web Connect File. NOTE: Take note of the date you last had a successful connection.

If you have overlapping dates in the web-connect process, you may end up with duplicate transactions. Click File Import From Web Connect.

If prompted for connectivity type, select Web Connect. The Account Association window displays during setup. For each account you wish to download into QuickBooks, click Select an Account to choose the appropriate existing account register. Important: Do NOT select “New” under the action column. Click Continue. Click OK to any informational prompts. Add or match all downloaded transactions in the Downloaded Transactions.

Repeat steps for each account to be reconnected. QuickBooks for Windows Conversion instructions Introduction As Anoka Hennepin Credit Union completes its system conversion, you will need to modify your QuickBooks settings to ensure the smooth transition of your data. Please reference the dates next to each task as this information is time sensitive. To complete these instructions, you will need your User ID and Password for online banking.

You should perform the following instructions exactly as described and in the order presented. If you do not, your online banking connectivity may stop functioning properly. This conversion should take 15–30 minutes.

Thank you for making these important changes! Documentation and Procedures Task 1: Conversion Preparation. Backup your data file. For instructions to back up your data file, choose Help menu QuickBooks Help.

Search for Back Up and follow the instructions. Download the latest QuickBooks Update. For instructions to download an update, choose Help menu QuickBooks Help.

Search for Update QuickBooks, then select Update QuickBooks and follow the instructions. NOTE: If multiple computers do not use the same QuickBooks data file, skip step 3.

QuickBooks activities such as Online Banking cannot be performed in multi-user mode because of the way the activities interact with a company data file. Switch to single user mode. For instructions to switch to single user mode, choose Help menu QuickBooks Help.

Search for Switch to Single User Mode and follow the instructions. NOTE: If you are not using Classic Mode (Register Mode), enable it for the conversion.

You can change it back after the conversion is complete. Enable Classic Mode (Register Mode). For instructions to enable Classic Mode (Register Mode), choose Help menu QuickBooks Help. Search for Banking Feed Modes, select Bank Feeds Modes overview, scroll down, and follow the instructions. Task 2: Disconnect Accounts at Anoka Hennepin Credit Union on or after 7/30/2018. Choose the Lists menu Chart of Accounts. Select the account you want to deactivate.

Click Edit menu Edit Account. Click on the Bank Feed Settings tab in the Edit Account. Select Deactivate All Online Services and click Save & Close. Click OK for any dialog boxes that may appear with the deactivation. Repeat steps for each account to be disconnected.

Task 3: Reconnect Accounts to Anoka Hennepin Credit Union on or after 7/30/2018. Log in to and download your QuickBooks Web Connect file. Click File Utilities Import Web Connect Files. NOTE: Take note of the date you last had a successful connection. If you have overlapping dates in the web-connect process, you may end up with duplicate transactions.

If prompted for connectivity type, select Web Connect. Click the Import new transactions now radio button, then click OK. NOTE: If you previously removed the check from the “Always give me the option of saving to a file.” option, then this dialog will not display. In the Select Bank Account dialog, click Use an existing QuickBooks.

In the corresponding drop-down list, select your QuickBooks account, and click Continue. Confirm the prompt by clicking OK. Repeat steps for each account to be reconnected. IMPORTANT: Verify that all transactions downloaded successfully into your account registers. Task 4: Re-enable Express Mode (if necessary) NOTE: If you prefer Classic Mode (Register Mode), you are finished with your conversion.

If you use Express Mode for online banking, you may now re-enable the mode. For instructions to enable Express Mode, choose Help QuickBooks Help. Search for Banking Feed Modes, then select Bank Feed Modes overview, and follow the instructions. Quicken for Windows Conversion instructions Important: Quicken for Windows Introduction As Anoka Hennepin Credit Union completes its system conversion, you will need to modify your Quicken settings to ensure the smooth transition of your data. Please reference the dates next to each task as this information is time sensitive. To complete these instructions, you will need your User ID and Password for online banking. You should perform the following instructions exactly as described and in the order presented.

If you do not, your online banking connectivity may stop functioning properly. This conversion should take 15–30 minutes.

Thank you for making these important changes! Documentation and Procedures Task 1: Conversion Preparation. Backup your data file. For instructions to back up your data file, choose Help menu Search.

Search for Backing Up Your Data and follow the instructions. Download the latest Quicken Update. For instructions to download an update, choose Help menu Search.

Search for Update Software and follow the instructions. Task 2: Disconnect Accounts at Anoka Hennepin Credit Union on or after 7/30/2018. Choose Tools menu Account List.

Click the Edit button of the account you want to deactivate. In the Account Details dialog, click on the Online Services. Click Deactivate. Follow the prompts to confirm the deactivation. Click on the General.

Remove the financial institution name and account number. Click OK to close the window.

Repeat steps for each account to be disconnected. Task 3: Reconnect Accounts to Anoka Hennepin Credit Union on or after 7/30/18. Download your Quicken Web Connect file from. Note: Take note of the date you last had a successful connection in your Quicken account.

If you have overlapping dates in the Web Connect download, you may end up with duplicate transactions. Click File File Import Web Connect File. Locate and select the Web Connect file to import. Import Downloaded Transactions window opens: Select Link to an existing account and choose the matching account in the drop-down menu.

Associate the imported transactions to the correct account listed in Quicken.